In USA, are you above an average credit score?

In USA, are you above an average credit score?

Which credit score range do you belong?

Your credit report is very important to get any type of loan.

What are Credit Scores?

Before you get a loan, the lender will know, if you are

eligible for a loan or not. That's why he checks your credit score and compares

it with the credit score range first.

Not only in the USA, it is said that your character is not

as important as your credit score ...! That is, these are not just jokes. This

is the truth

Let's know what is the average credit score in the USA and what the credit score range should be for getting any type of personal loan, car loan, home loan or credit cards.

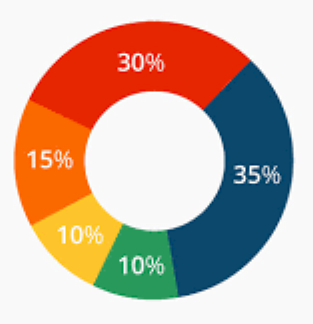

In USA, FICO developed the credit score most lenders use to

determine your credit worthiness. Each of the three major credit bureaus

(Equifax, Experian and TransUnion) have a FICO score for you.

The calculation they use is the same, but sometimes they don’t all have the same information, so your credit score may vary slightly among the three. 300 to 850 is the FICO credit score range for consumers.

Each of the three credit bureaus also has its own credit

scoring model. Credit scores are educational for consumers, although lenders

don’t use these. To determine the score, the credit bureaus use credit

information in the specific credit report. Here are the credit score ranges for

each of these credit bureaus:

Equifax: Equifax Credit Score Range in America

- 280 to 850

Experian: PLUS Credit Score Score Range in America

- 330 to 830

TransUnion: TransRisk Credit Score Range Score in America

- 300 to 850

The three major credit bureaus also jointly created the

VantageScore credit scoring model. It’s maintain and managed by an independent

company. Some lenders may use the VantageScore in determining someone’s credit

worthiness.

What is credit score range for VantageScore?

VantageScore has three versions: VantageScore 1.0 and 2.0,

which use a score range of 501 to 990, and VantageScore 3.0, which uses a credit

score range of 300 to 850.

To add to the confusion, even more scores are available to

consumers. They include the CE Score, Credit Optics Score, CoreLogic and

RiskView. Just because lenders don’t use these scores doesn’t mean they can’t

be helpful.

If you use one of these scores or a service that provides

you with one of these scores, it can be a useful monitoring tool. These

services use information in your credit report to calculate your score.

If you have a goal to increase your credit score to qualify

for a loan in the future, you will be able to see if your score is increasing. By

using one of these and continuing to monitor your score, you can see how you’re

doing using a big picture. If you score drops significantly and you don’t know

why, it can be an indication of an error on your credit report.

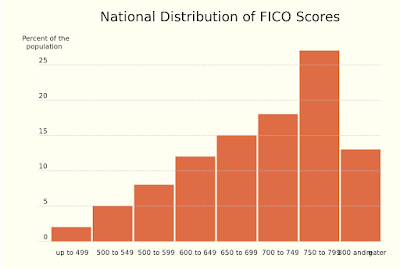

What is average credit score in USA?

According to consumer credit expert John Ulzheimer, the

average American’s FICO score crested 700 for the first time in 2017, an

all-time high. “A score of 700 gets you to about the 50th percentile

nationally,” Ulzheimer says.

Bad Credit: 300-650

A score below 650 means you’ll have a harder time qualifying

for loans or credit cards, and may have to pay much higher interest rates when

you do.

“A score of 650 is generally used as the dividing line

between prime and subprime,” Ulzheimer says, referring to the point at which

lenders consider you a much greater risk.

Fair Credit: 651-700

The average American’s FICO score crested 700 for the first

time in 2017, an all-time high. “A score of 700 gets you to about the 50th

percentile nationally,” Ulzheimer says.

Good Credit: 701-759

If your credit falls within this range, Ulzheimer says,

you’re likely to get approved for whatever you’re applying for. But, he adds,

“There’s no guarantee you’re going to get the best deal the lender has to

offer.”

Excellent Credit: 760 and above

Ulzheimer says a score of 720 is enough to get the best

published interest rates on an auto loan, but the best mortgage rates are only

available to people with credit scores above 760.

“So, I’d define an ‘excellent’ credit score as one that

ensures the best possible deals across all lending environments, which is 760

or above,” Ulzheimer says. In fact, in practical terms, Ulzheimer says a

perfect 850 credit score is no better than a 760.

Let’s understand what your credit score means?

Why you have several of them, how they’re calculated, and

how to improve a bad credit score.

A good credit score can make your life much, much easier.

It’s easier to get a

loan: Most people know that bad credit can make it hard to get a mortgage,

a credit card, or an installment loan. And even if you can get a creditor to

give you a chance, you’ll probably be paying a much higher interest rate than

you would if you had a good credit score.

Bad credit also means you are getting a cosigner or putting

up collateral.

It can be easier to

get a job: Though a handful of states have outlawed or limited the

practice, in most cases, prospective employers are allowed to check your

credit. Though they won’t see your score, they’ll still see any major problems

dragging it down, such as frequently missed payments or legal issues. Black

marks can indicate a lack of responsibility and potentially cost you a job

offer. Regulatory agencies can also refuse to license professionals with poor

credit.

Your insurance rates

may be lower: If you have a good credit score, you could pay less —

sometimes much less — for car and property insurance than someone with bad

credit. That’s because insurers’ research shows that you’re more likely to file

a claim if you have bad credit, which makes you a riskier customer. A few

states (California, Maryland, and Hawaii) do prohibit this practice.

It can help you

launch a small business: Your personal credit may be all you have to go on

when you need to borrow money for a fledgling business. It can get extremely difficult if

you have a bad credit score.

It can help you get

an apartment: good credit is essential for getting a mortgage, but it can

also help you get a good apartment. On the flip side, prospective landlords may

refuse to rent to you — or charge you higher rent — if you have bad credit

because they’re worried you won’t pay the rent on time.

As you can see, good credit is about more than borrowing money — it can help you in deeply personal ways, from easing your apartment hunt to landing your dream job. .

Labels

Finance

Post A Comment

No comments :